- Best personal budget template for mac how to#

- Best personal budget template for mac pro#

- Best personal budget template for mac download#

There are three versions available for Mac, and as you’d expect, each price increase enhances the feature set. This would be my choice for your ‘tax and vat’ package – the reporting is excellent and translates into other platforms, so your bookkeeper (and accountant) will love you for it. It’s also comparatively pricey – but as I said earlier, you pays your money… This is a feature heavy and time proved piece of software, so will necessitate more of a learning curve than some others here. It features a desktop/ios version that syncs perfectly with its web-based sibling, so you can work on or refer to your data anywhere. Pricing – three versions - $35.99/yr - $46.79/yr - $70.19/yrĪ comprehensive package with an excellent suite of finance management tools. The following, therefore, aren’t listed in any particular order of merit. I find it easier to split tasks between four apps, as each has its own virtues. I also have two virtual bank accounts on both machines (and these are, of course, free).

Best personal budget template for mac pro#

Personally, I have an accounts package on my MacBook Pro for VAT and tax tracking and reporting duties, and a budgeting app on my iPad. In other words, you may not need every whistle and bell. You may only need a virtual bank, or a place to view all of your account balances simultaneously. …or not! As with all apps, decide exactly what you want any of these apps to do for you in advance (and before you part with any money). I’ve noticed that many personal financial apps favour the very simplistic dashboard look – maybe even just an account balance, so you’ll need to spend a little time familiarising yourself with the app navigation and particular nomenclature before you're ready to dive under the hood. Under the dashboardĪs with many other app types these days, the landing point is the dashboard. You (obviously) have to log in and clear security to link your accounts within an app, as security is always paramount.

Best personal budget template for mac download#

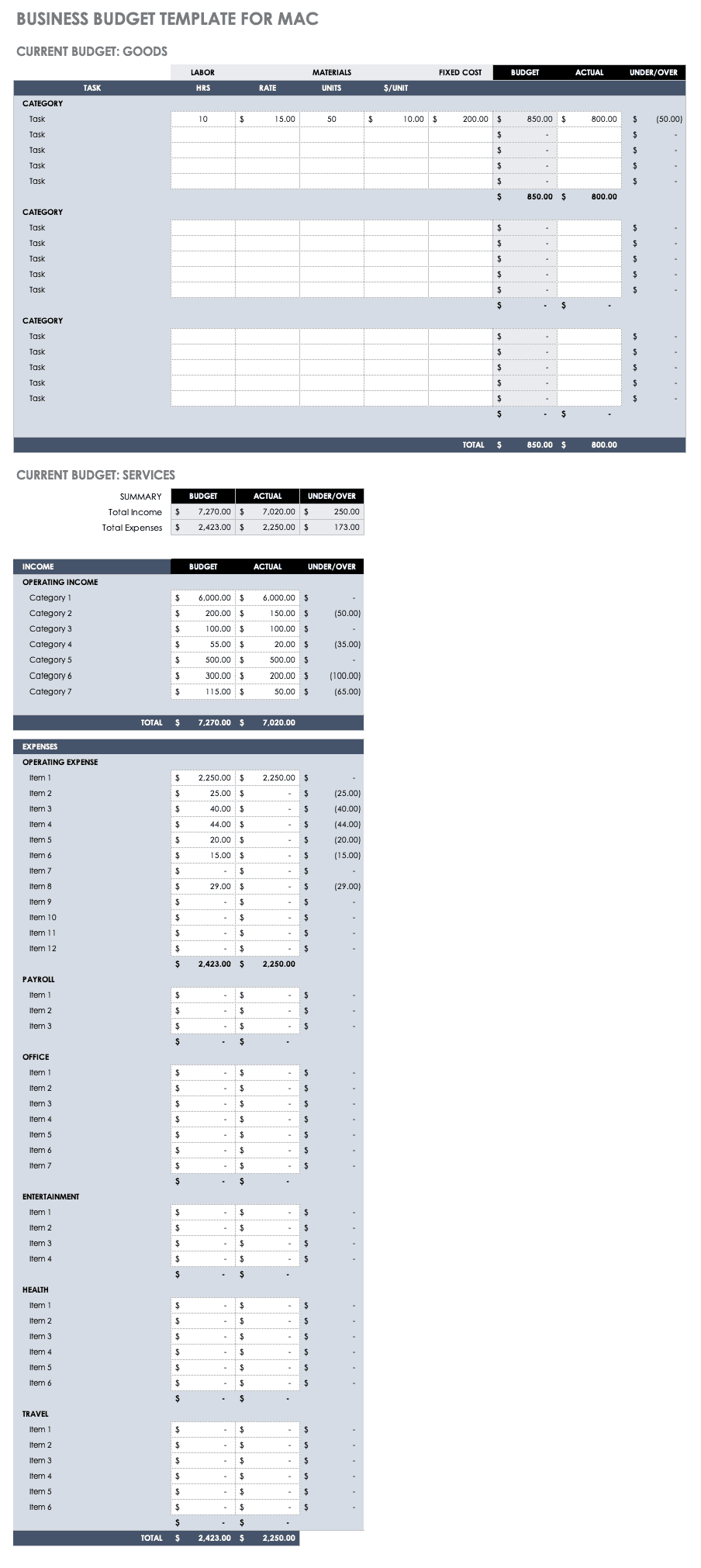

This means that you can download statements and reports that can be collated in the app in a logical format. Most of them support connections to your banks or financial institutions. The apps below very often share some common characteristics. Most importantly of all, every app below has a very thoroughly thought-out security strategy – the top critical consideration when dealing with your money online. No more juggling three or four tabs to stop sites from timing out on you. Many of the MacOS finance apps available or more than capable of revolutionising your financial life – as well as being able to gather all your various bank accounts, bills, investments, credit cards etc. No supercilious bank manager to patronise me, either. I’ve switched over to a bank that has no front door (or any doors, for that matter), and it works really well for me. My MacBook Pro is perfectly capable of flying me to the moon, but recently I’ve been using it to budget and manage my finances way more effectively than I’ve been able to before. To the right, use the drop-down to grant permissions to the sheet for each person.We’re all now long used to banking, paying bills and shopping online, but the last few years have seen an explosion of apps for managing, consolidating and synchronising our financial information on our iPads, iPhones and desktops.

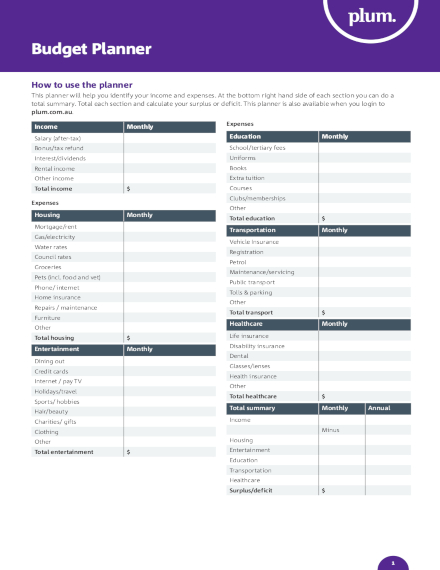

Select the Share button on the top right of the workbook and enter the email addresses or contact names.

Best personal budget template for mac how to#

RELATED: How to Share Documents on Google Docs, Sheets, and Slides Alternatively, you can simply grant them access to see the budget if you prefer. You can provide those you share with access to make edits which is handy for them to add their own amounts. No matter which option you choose to create your budget in Google Sheets, sharing is simple. The basic functions in Google Sheets can help you with the calculations you need. Since you’re creating this budget from scratch, you can make it as high-level or detailed as you want. Or, you can add sections for savings and investments or various sections for different types of expenses. For example, you can see the total salary amount as it grows throughout the year. If you want more detail for your income and expenses, you can add totals for each row too.

0 kommentar(er)

0 kommentar(er)